Despite the fact that TCU Start - this warehouse program, which

takes into account all the usual trade operations, TCU Start

no module Cashier. How important cash

operation, what advantages they offer, what opportunities are being

to the user?

Keeping cash.

appears to form two main types of

cash instruments - cash order receipt and expenditure cash

warrant. Thus, we can display the very essence of trading

Operation:

a) by purchasing the product form for entering credit bill

product and form consumable cash order for payment of the

procurement;

b) in the sale of goods form the expenditure invoice for shipment

goods, cash receipt form and the warrant under which the buyer with

we have calculated.

It is also worth noting another important point. In addition to

movement of money as a result of trade transactions, there is a class

financial instruments, which need to track in accounting

system. This is all the overhead costs associated with commercial

activities.

The most important of them:

1. Payment of wages

2. Rental

3. Utilities (electricity, gas, heating, etc.)

4. All kinds of planned and unplanned expenses (maintenance, travel,

petrol / diesel).

The question arises - how to record cash

operations, not just a bunch of common documents, a so that they can be clearly

classified by a particular type. After a while

TCU user wants to know how much money was spent,

for example, from the beginning of the year for electricity, which amount was paid

in the form of salary, as increased costs for gasoline, etc.

The most reasonable solution - to have documents

specific, clearly defined labels or signs, which can be

select the documents they summarize and display the amounts

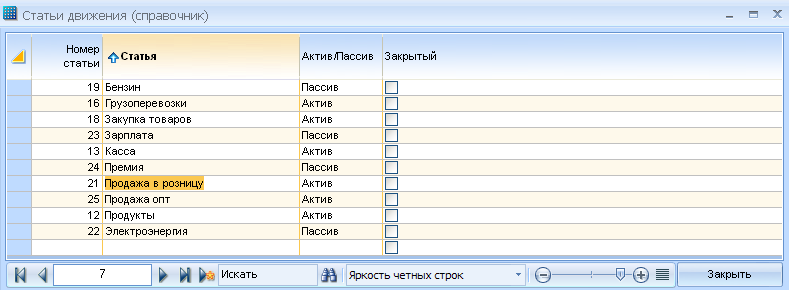

form results. In TCU used for this purpose article of traffic (Tab

«Directories» -> «Articles»). Open a directory of articles and type

required us to become the movement of documents. In this example, depicted

Directory of articles from the test database.

Articles may be added or changed. Articles do not

limited. Please also note that the article can be active

or passive. Let's see what the difference between them. Wiring

instrument with a given active section leads to a change in the amount

to mutual counterparty, instrument cables with a passive section is not

leads to a change in the amount of the counterparty to transactions. When and how

Articles should be applied? If we pay for electricity - it is

passive art. If we pay for travel - it is passive

article. If we purchase goods - it is an active article, if

We pay for shipment of goods - is also an active art. In fact,

- Passive article serves only to simplify accounting. Ideal

to pay for petrol on the active article (from the gas station in front of us

a debt), income to take the invoice to the warehouse petrol

(The gas station to pay their debts shipped to us with gasoline), then

act of converting gasoline to cancel this residual (indicating the grounds on

what purposes, to whom and where). To simplify accounting, we simply do

payment of money at the gas station for gasoline (debit cash order) Passive

article. Debt WSA does not change (as a rule, it is zero), we

in turn, this gasoline is used. The fact that the purchase of gasoline and its

confirmed by the use of cash expenditure warrant. Too

respect and staff salaries. Staff entered into the directory

Customer TCU, which is convenient to create a separate group of customers

«Staff». They are being paid salaries for the passive section

«Salary».

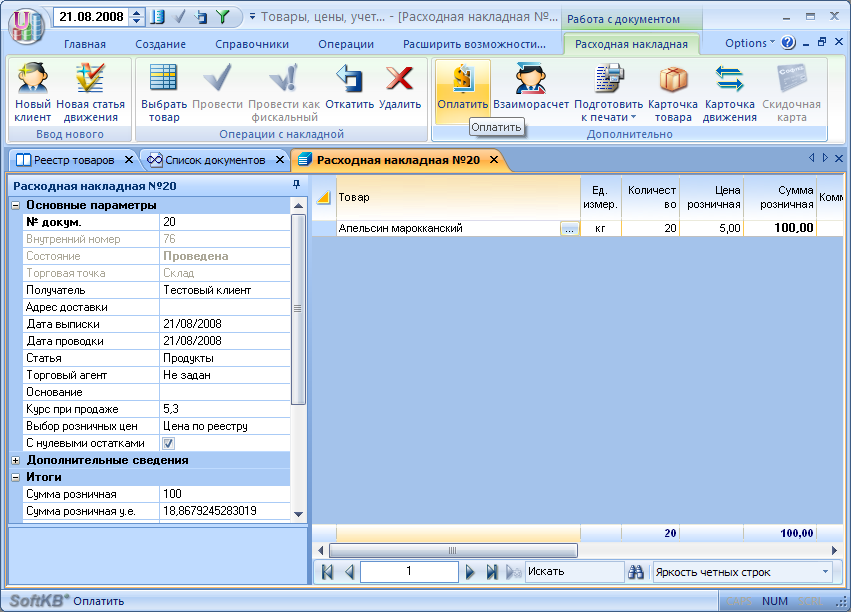

Now, let's work papers, held on

active object in the case of sale of goods.

We form expenditure invoice indicating active

Articles «Sale of goods» (the title of the article can be arbitrary, and

described as an example), indicating the buyer. We carry out expenditure

invoice, click on the icon «Payment» in content tab of expenditure

invoice. It will be automatically created receipt cash order, which

will contain all necessary information for payment. The amount of payment may

be changed. Draw it on the same article «Sale of goods» (article

may be specified, but it also must be active). In this

event will be the buyer paid in full (if

given the full amount of the invoice in cash order), or partially, if

Kazana just part of the total invoice.

Let's see how to make an analysis of our business

activities in the article by section.

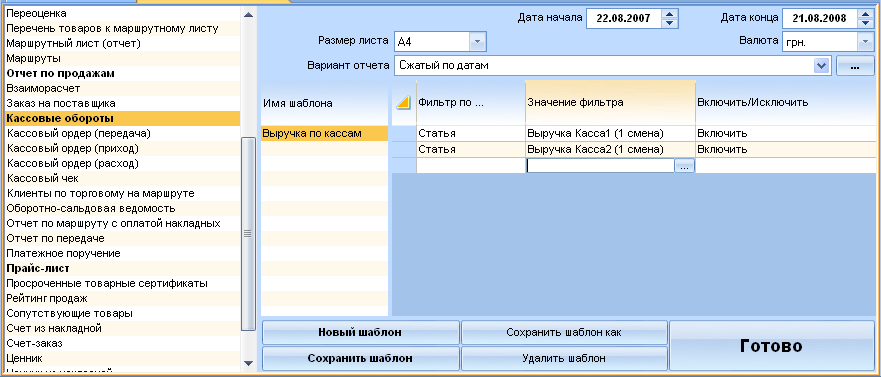

Open «Master records» (Tab «Home» ->

«Master records») and select the report «Cash revolutions», specify the filter

Articles of interest to us.

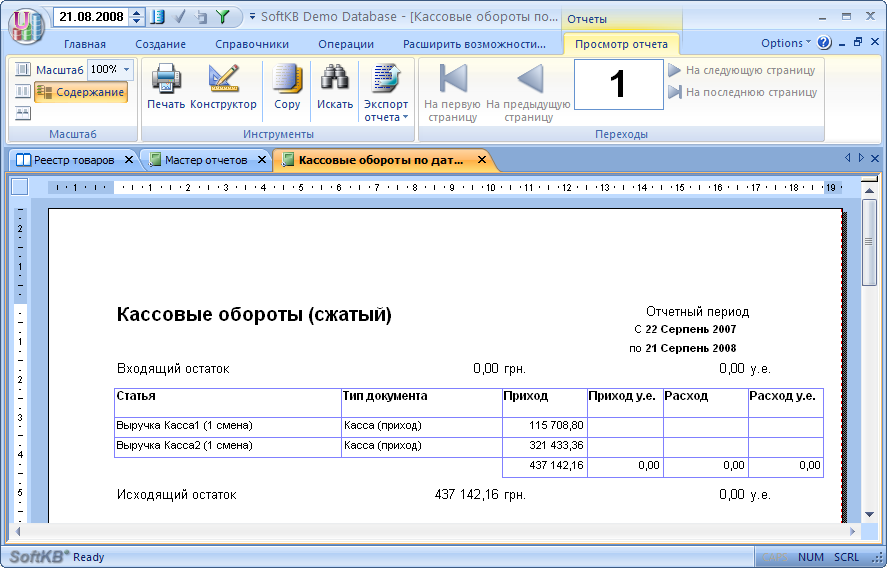

click on the button «Finish».

receive the report.

The sample for any of the articles of traffic (you can specify

several articles) will allow you to receive answers to many interesting

your questions.

Shops sell, the money in the cashier receives what

occurs at the intersection of these two processes?

We are gradually coming to the next interesting topic --

mutual.

mutual - it's easy. To sell at 100

grn. Vaasa client paid us Vasya UAH 80, and 20 UAH. he us

should remain. Do I have to TCU tracking customer debt

take any special action? No, you do not.

Arrangements with suppliers and buyers in TCU tracked

automatically. Let's see how this works.

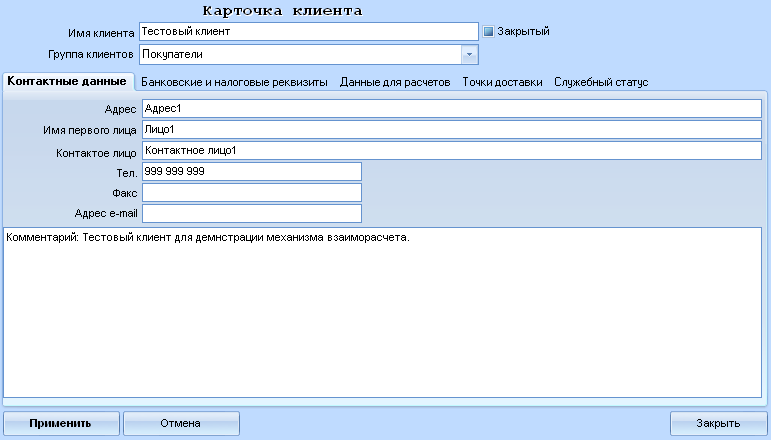

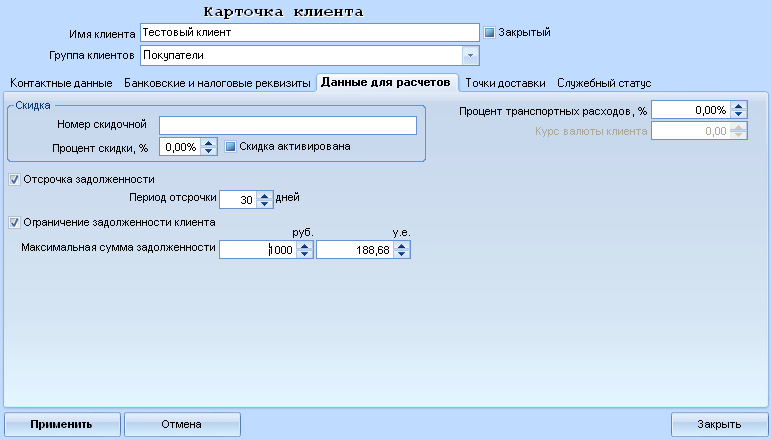

add a new client in a directory (tab

«Directories» -> «'s clients» -> «Enter new»).

accents and details click on the tab «Data

for the calculation ».

On this tab, we can exercise control

outstanding customer debt on time and in amount

debt.

a given period of deferment of 30 days, it would be impossible to

ship the next invoice, if the client within 30 days is not paid

arrears on a previous invoice.

specify a maximum amount of debt, such as

1000 UAH., The operator will not be able to ship the consignment note, the amount of

exceed 1000 UAH.

Monitoring date and amount will allow you to

relationships with customers and suppliers, under the clear control

allows easy monitor the current debt and does not exceed the total

permissible amount of debt for all customers in general. This is particularly

true for companies engaged in wholesale trade on a deferred

payments for deliveries.

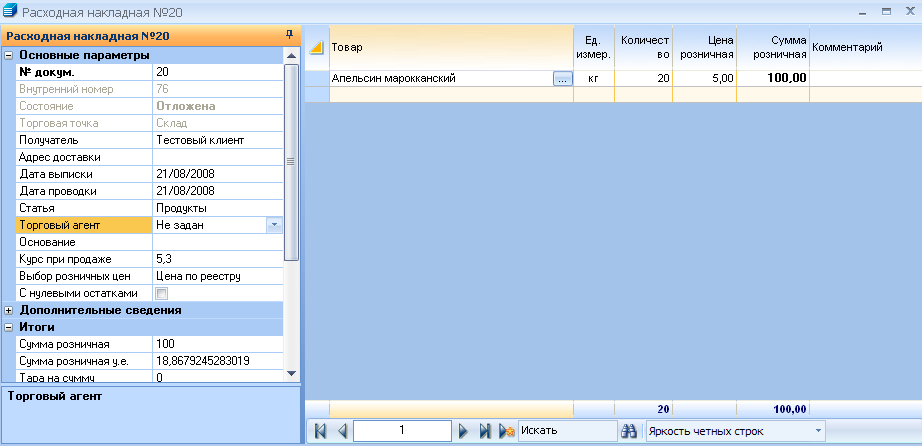

Let's try to ship goods to our client in the amount of

100 grn and to take into account this two-bill payment, 60 and 30 grn.

To do this, create a new expenditure bill,

drive the goods to 100 UAH and hold it.

Once the bill done, click on

button «pay».

It will be automatically created and opened receipt

cash warrant in the amount of UAH 100. Correct amount of UAH 100. 60 hrn.

(I have no such client money ...) and draw cash order.

Back in the expenditure invoice and click again on

icon «pay». This will create another receipt with cash order

the sum of 40 UAH. (the remaining outstanding amount under this bill).

Change the value of 30 UAH. and draw cash order.

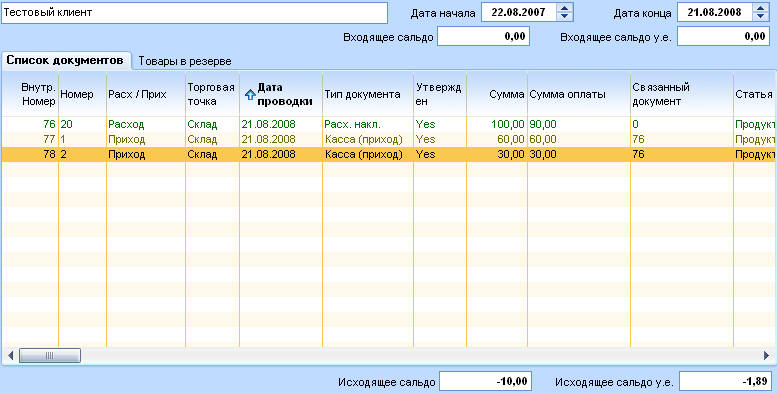

Now is the time to look at the card the customer

mutual. There are several ways to open the card, the customer

of transactions. In general tab «Home» Press

button «mutual», a list of clients in which we choose

the desired client and opens his card. In our case, there is much

faster way. While in our spending bill, click on

button «mutual». A card for mutual clients.

Here we see all the documentary movement in the

view of the customer. If there are any disputes, questions, comments --

All this is very easy to allow easy opening of the card. If the card

need to print, this is easily done by clicking on the printer

Content tab.

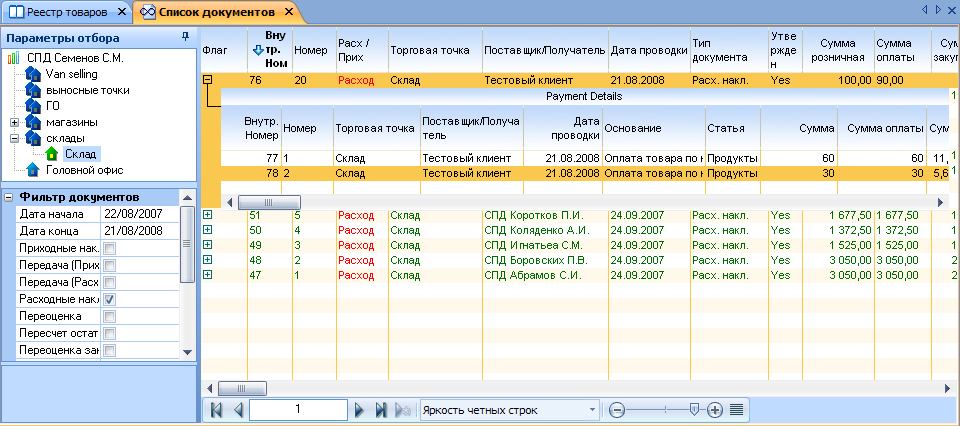

By the way, you will never pay attention to «+»

opposite each spending bill in the list of spending bills?

Open the list of spending bills, to select our bill and press

«+».

disclose payments that are associated with this

consignment note, against which they were received. Thus, we can see

not only the total amount of debt the client, but the sum for each

consignment note, as our overhead closure fee.

Tell about all the possibilities of the system of payment and

of settlements in this letter is not possible because of the

restrictions on its length. Later SoftKB will regularly highlight

topics of practical use TCU, as the accumulation of

users, assess their importance and relevance.

If you are interested in opportunities TCU Standard and

you are currently using TCU Start, then move on to the editor TCU

Standard is a snap. For this tab «Expand opportunities»

Click on the icon «TCU Standard». Register TCU Standard can be

on our website

http://andriy.co/shop